The More You Know

The “Did You Know?” Campaign for Golden Triangle Emergency Center- Orange is an informative campaign launched to further educate the public on the services we offer our community, how to understand your bill and the laws that are in place to help you.

Understanding your (EOB)

The Explanation of benefits (EOB) is a form that the insurance companies will send to their members to explain what part of a claim was paid by insurance, what part was not paid, and why.

How to Read Your EOB

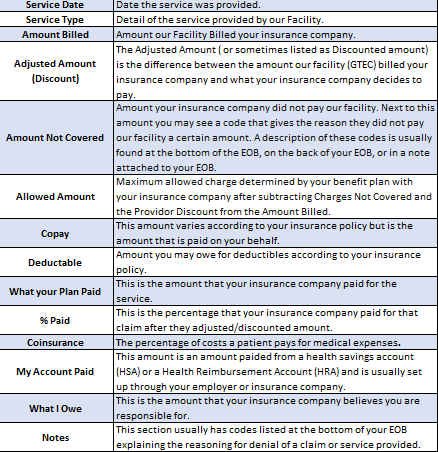

An EOB from your insurance company will typically include the following information:

Top of Your EOB: Date of Service and Member identification information, and the claim number. You will need this information to check on the status of a claim.

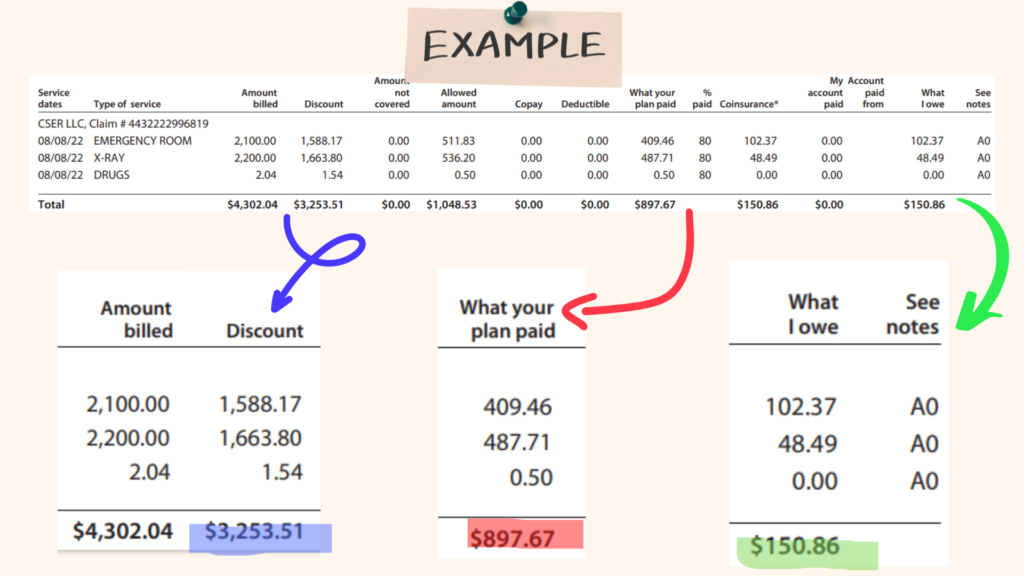

Under Claim details: You will be provided the amount billed, adjusted amount (Discounted), amount not covered, Co-Pay, Deductible, Co-insurance, what your plan paid and what you owe.

A bill for any amounts you may owe will come separately. Review it carefully to make sure you actually received the services being billed, that the amount your healthcare provider received and your share are correct, and that your diagnosis and procedure are correctly listed.

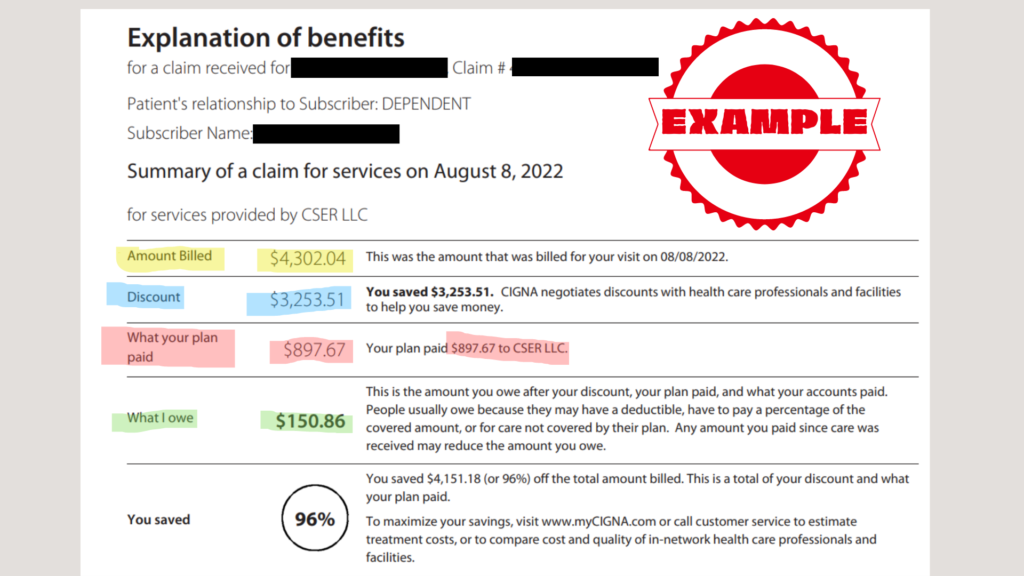

An Example of an EOB

Highlighted in Yellow is the amount billed by our facility. Highlighted in blue is the amount your insurance company adjusted/discounted off. Highlighted in red is the amount your insurance company paid. Highlighted in green is the amount you a projected to owe.

Diving Deeper into this EOB

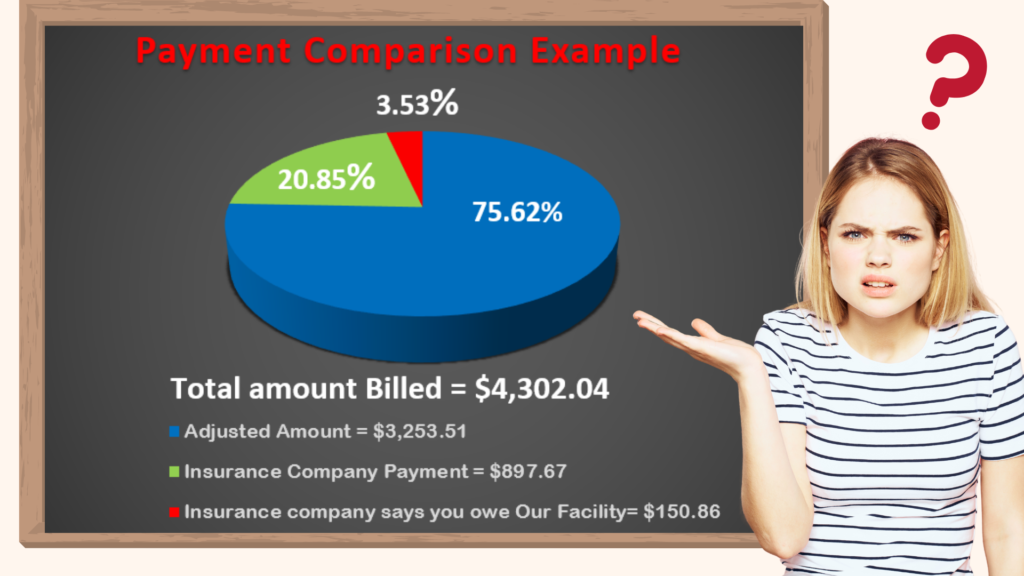

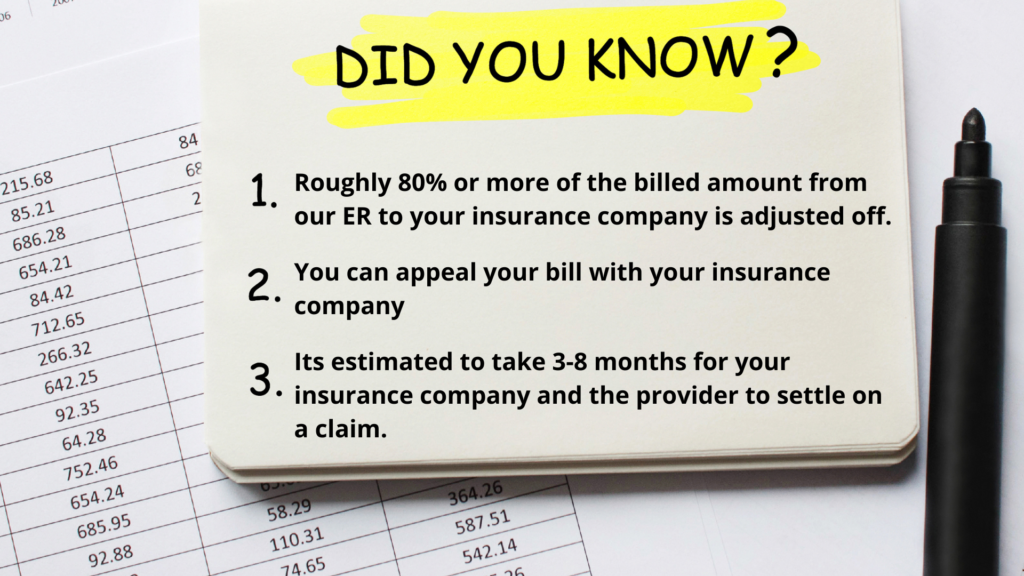

In this graph you will see our facility billed $4,302.04 to this particular insurance company. The insurance company adjusted off $3,253.51 or 75% from the total bill and paid $897.67 or 20%. This leaves the patient responsible for $150.86 or 3.5%. However, the problem with this example is the patient has met their deductible and insurance should cover more than 20%.

Adjusted Amount

The Adjusted Amount ( or sometimes listed as discounted amount) is the difference between the amount our facility (GTEC) billed your insurance company and what your insurance company chose to pay. This amount is not what the insurance company paid.

Breaking Down of the EOB

It is important to always check over your EOB closely. You may have received a service that is not covered by your insurance in which case you are responsible for paying the full amount. Your EOB will generally indicate how much of your annual deductible and out-of-pocket maximum have been met. If you’re receiving ongoing medical treatment, this can help you plan ahead and determine when you’re likely to hit your out-of-pocket maximum. At that point, your insurance company will pay for any covered in-network services you need for the remainder of the year.

Assistance

Filing an insurance appeal

If your insurance company denies a claim for treatment, you have the right to appeal. The policy holder or guardian can write a letter supporting your case and provide documentation, such as journal articles, list of symptoms, to support why a certain procedure or treatment was medically necessary.

You can file an appeal up to 180 days after you are notified of a denial. The explanation of benefits (EOB) you get from your insurance company will have information about how to file. If you do, your insurer must do what the U.S. Department of Health and Human Services calls a “full and fair review” of its initial rejection. If you lose here, you can request an “external review” by an independent organization accredited to review health care decisions.

The Patient Advocate Foundation has a downloadable guide with detailed advice on navigating this process, including sample appeal letters and a checklist of evidence to gather.https://www.patientadvocate.org/

Appeal Tips

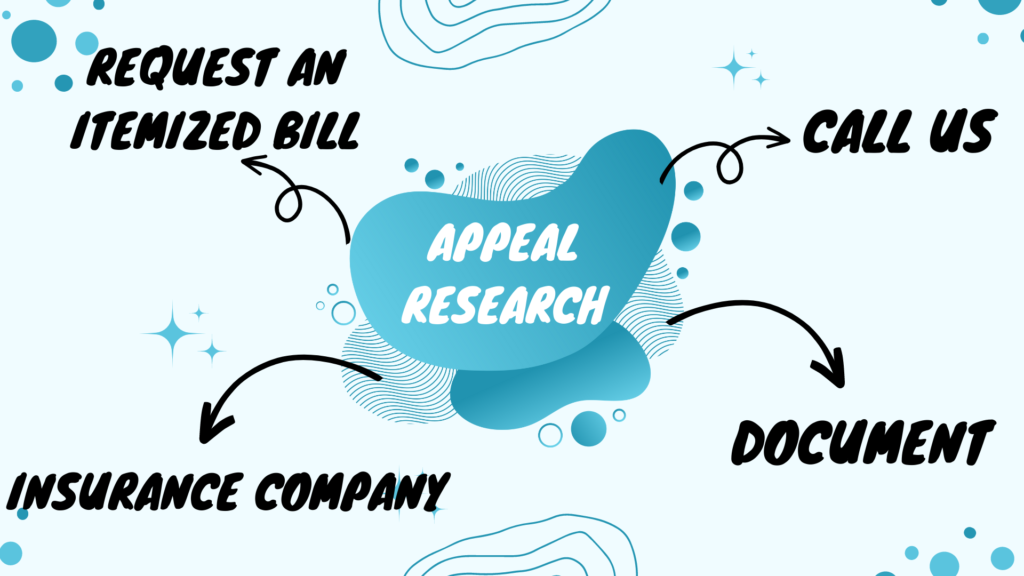

- Get the itemized bill: Our facility sends a bill that summarizes the services you received and lists payments for each service as well as a total amount.

- To spot problems, ask for an itemized statement, this is just a more detailed explanation of the services provided.

- Take notes/Gather evidence: Starting with your first phone call, write down the date and time, the name of every person you talk to and the information they share. If you hit a brick wall request to speak to a supervisor.

- Check to see if you are being charged for services you didn’t receive, medications you didn’t take or facilities you didn’t use.

- Compare the bill with the explanation of benefits (EOB) sent by your insurance company.

- CALL US: Ask our facility about any charges you don’t understand, point out any obvious errors and request that they review your bill.

- Contact your insurance company: If your health plan isn’t covering something you thought would be covered, call the customer service line and ask directly, “What needs to happen for this to be covered? ”Sometimes, it’s just a matter of the medical provider entering the wrong code when it submitted your claim.

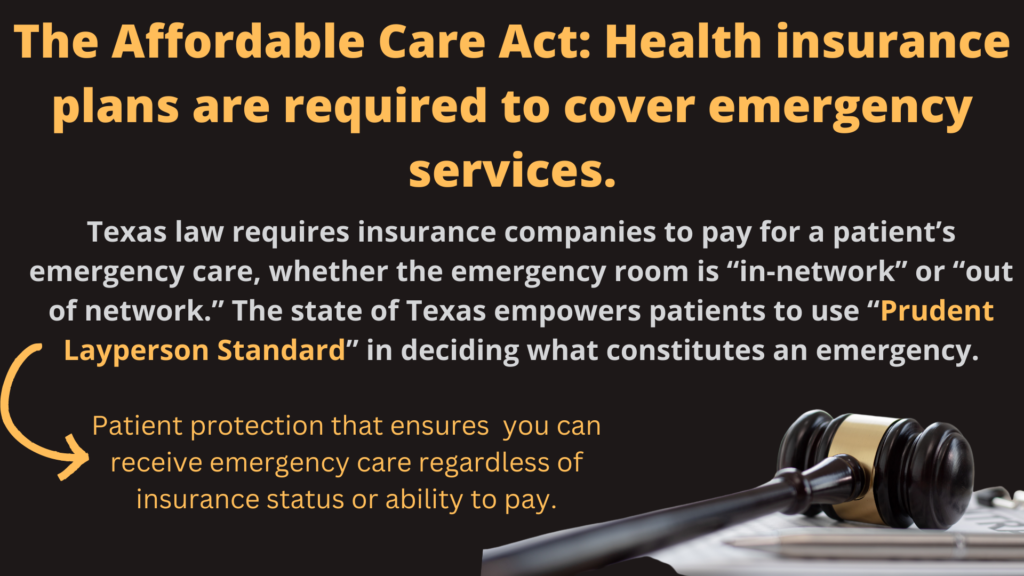

Affordable Care Act

Prudent Layperson Standard

One of the most important principles supporting the medical safety net is the “prudent layperson” standard for defining an emergency, which requires health insurance plans to base reimbursement on a patient’s presenting complaint rather than the final diagnosis.

This means insurers must cover emergency department care, for example, when a patient’s severe chest pain turns out to be heartburn rather than a heart attack. Such a determination often takes hours, multiple diagnostic tests, and the considered judgment of an experienced emergency physician. Under the prudent layperson standard, insurers cannot use the final diagnosis as an excuse to deny coverage.

Affordable Care Act

What is the Affordable Care Act? The “Affordable Care Act” (ACA) is the name for the comprehensive health care reform law and its amendments. This law addresses health insurance coverage, health care costs, and preventive care.

Rights & protections

The health care law offers rights and protections that make coverage more fair and easy to understand.

- Requires insurance plans to cover people with pre-existing health conditions, including pregnancy, without charging more

- Provides free preventive care

- Gives young adults more coverage options

- Ends lifetime and yearly dollar limits on coverage of essential health benefits

- Helps you understand the coverage you’re getting

- Holds insurance companies accountable for rate increases

- Makes it illegal for health insurance companies to cancel your health insurance just because you get sick

- Protects your choice of doctors

- Protects you from employer retaliation